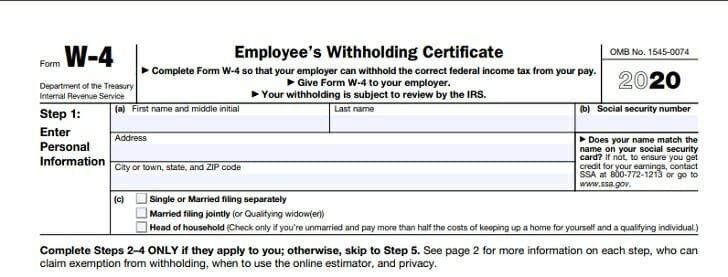

This Pesky, New W4 - 2020 and later

This short blog post is not going to cover every aspect of the NEW W4 form that the IRS has created. This is the form you give to the employer to determine the amount of tax payments taken from your check with each payroll cycle- take a look at it: https://www.irs.gov/pub/irs-pdf/fw4.pdf

Crazy? Well, it even comes with a hour long tutorial from the friendly folks at the IRS and as the presenter states, no CEUs are offered for watching this online! (gosh, I have to attend another conference to get my final CEU)

https://www.youtube.com/watch?v=jqXuQn0yP6o

I realize that many of our clients don't want to spend too much time on this so here is some quick suggestions for filling this out. Remember, this only applies to Federal taxes, not state. States can feed off the Federal form, have their own, or come up with some really zany approaches like Arizona does where they ask you what percentage withholding you want.

The EASIEST advice: Want a really BIG refund (but a smaller paycheck)? Fill out your name, address, the marital status you use on your tax return, check box 2c and sign at the bottom. DONE! Disregard the wording of the questions as a traveler will never fit the descriptions. The label may be wrong, but the math behind the declaration on the form fits. Remember, you don't give this to the IRS, you give it to your employer. You wont be taken to jail for what you put on this!

Now- that advice should handle those that view their returns as savings accounts, but realistically, the dilemma many travelers face is that many have different wages with each job and some can be all over the place. 25/hr at one, 15/hr at another, short hours one week, OT the next etc. We don't have average, dull, one job a year lives!

The next piece of advice applies to SINGLES who don't want a Super Gulp sized refund and whose wages are within $2 for each contract:

To compensate for the varying wages AND for some, to ensure that there is a sufficient Federal refund to cover the state amounts due (for those in high tax states), you need a buffer. Here is the best guide to keep things simple, and I am assuming you get paid WEEKLY. Double this if you get paid BI-WEEKLY. Assume you work 52 week a year. To get a $1000 refund, you need to overpay your taxes by roughly $20 each check (20 X 52 = $1,040) (40 x 26 for bi-weekly). On the W4, fill out your name, address, marital status you will use on the return (assuming single or separate here), skip to line 4c and put $10 for a $500 buffer, $20 for $1,000 etc. If you anticipate only working 48 weeks (4 contracts with a week off in between), divide $1,000 by the weeks you will work.

Again, this works only when your wages amount is consistent through each contract. The more erratic the wages, the more likely you should just check Box 2c and be done.

MARRIED? HEAD of HOUSEHOLD? There is way more to this, and at this point you are best calling us or wait for my next entry. You can use the quick fix noted in red above. Unfortunately, the forms are not designed to be simple - see the next paragraph. If you are so inclined, here is a really good video that is more in-depth: https://www.youtube.com/watch?v=_VPjX0dDTgs

One important thing to note - these revisions to the W4 are designed to keep refunds low - for many, that's a new language. AND, travelers don't fit cookie cutter solutions either , but hey, that's why we are here!